Everything About Long & Short Trades

While discussing trading, short trade and long trade are two terms that are being used often. In simple words, long trade can be considered as the trade that profits you when if it’s value increases in comparison to a relative reference value. Similarly, a short trade can be considered as the trade that profits you when it’s value decreases in comparison to a relative reference value. When performing a trade, you are long of that from which you will get profited if it increases in relative value and is short of that from which you will get profited if it decreases in relative value.

Let’s consider an example to know it better. Just consider that you bought a stock of X Company with Euro. In this case, you are the long stock of X company and short stock of Euro. In other words, the value of X company’s stock must rise in comparison to Euro to let you make a profit. On the other side, the value of the Euro must fall in comparison to X company’s stock to let you make a profit.

In terms of Stocks & Commodities

Before 1970, when the value of the U.S. dollar was defined as $35/ounce of gold, forex trading used to be performed on a very small level. At that time analytical traders emphasized on commodities and stocks. The straightway to get profited was to purchase stocks and commodities at a lower price and then selling them at a relatively higher price. At that time, traders needed an idea to get profited (without already owning any stocks or commodities) as soon as they came to know that prices are going to decrease. This was the time when short trade practices came into existence.

The prime thing to know here is that stocks be inclined towards long trade i.e., mostly stocks’ value increase with time then decreasing. So we can say, if you make a trade in which you wish for the price to drop in the chart, you’re playing short of that trade.

In terms of Forex Trade

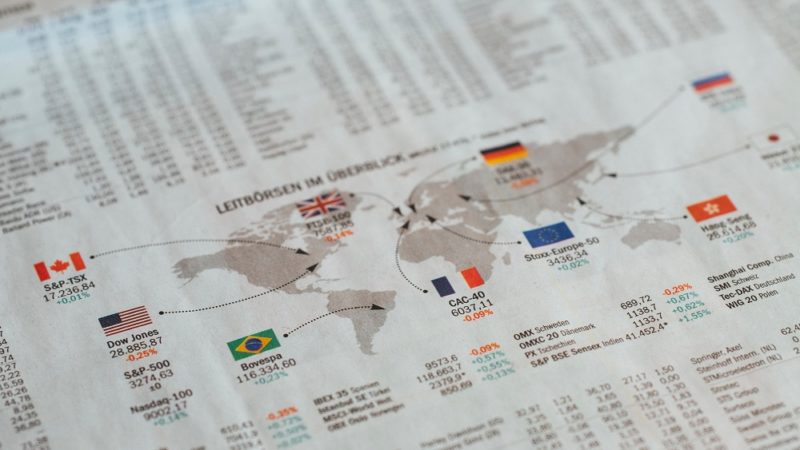

In foreign exchange, these things are totally different. Because either you’re performing short trade or long trade, you always be short on one currency and long on the other one. In forex trading, either you buy currency or sell it against another currency. Let’s consider that you’re buying (going long) USD with EUR i.e., USD/EUR; then, you’ll be long USD and short EUR. If you’re Selling (going short) USD with EUR i.e., USD/EUR, then you’ll be long EUR and short USD.

The essential thing related to the long and short trades is the interest you might have to pay to your corresponding. Considering the above currency pair to explain. Let’s consider that you buy USD with EUR i.e., USD/EUR. If the inter-bank interest rate for USD is more than that of EUR, then you will be paying a certain amount indicating the difference. In case the interest rate for EUR is more than that of USD, then your broker will be paying you a specific amount every time you stick the position because you’re receiving interest on your EUR greater than the interest they’re receiving on USD.