Buffet Said His Conglomerate Berkshire Has Sold All Airline Stocks

The chairman and value investor Warren Buffett recently said that the conglomerate Berkshire Hathaway has sold all of the airline industry stocks due to the coronavirus situation. He said that the world is changing and so should we.

“When we bought [airlines], we were getting an attractive amount for our money when investing across the airlines,” he said. “It turned out I was wrong about that business because of something that was not in any way the fault of four excellent CEOs. Believe me. No joy of being a CEO of an airline.”

“I don’t know that three, four years from now people will fly as many passenger miles as they did last year,” he said. “You’ve got too many planes.”

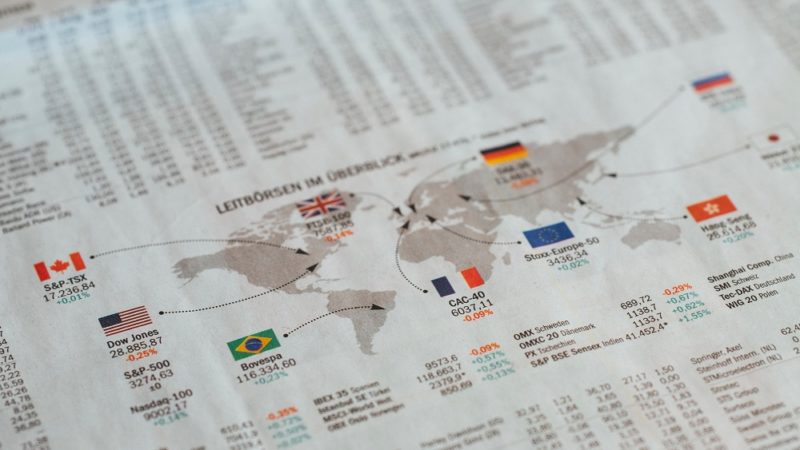

We have let go of those Airline stocks because we think the recovery will not be as smooth and swift as the downfall. Before this, the total stock value that the conglomerate had in those stocks was worth $4 billion which included the stocks of famous airline industry companies like delta airlines, Southwest, American, and United airlines.

“When we sell something, very often it’s going to be our entire stake: We don’t trim positions. That’s just not the way we approach it any more than if we buy 100% of a business. We’re going to sell it down to 90% or 80%.”

“If we like a business, we’re going to buy as much of it as we can and keep it as long as we can,” he added. “And when we change our mind we don’t take half measures.”

He said the demand has definitely taken a high toll because the supply is also at rock bottom due to the coronavirus and various precautions undertaken by the government. The industry is collapsing and the recovery looks feeble.

He made these statements during shareholder return letter and after the conglomerate, Berkshire Hathaway reported their first-quarter earnings.