‘Not Too Late to Cash the stocks as the Worst of the Economy is Yet to Come’, Mark Yusko

Mark Yusko, CEO and CIO of The Morgan Creek Capital Management warns the investors to prepare for a historic market bottom. The Hedge Fund Manager also compares the current coronavirus hit economy to the one during the great depression.

“The economic shock wave that’s coming is going to be like nothing that any of us has ever experienced because it’s going to be very similar to the 1930s,” he told CNBC on Thursday.

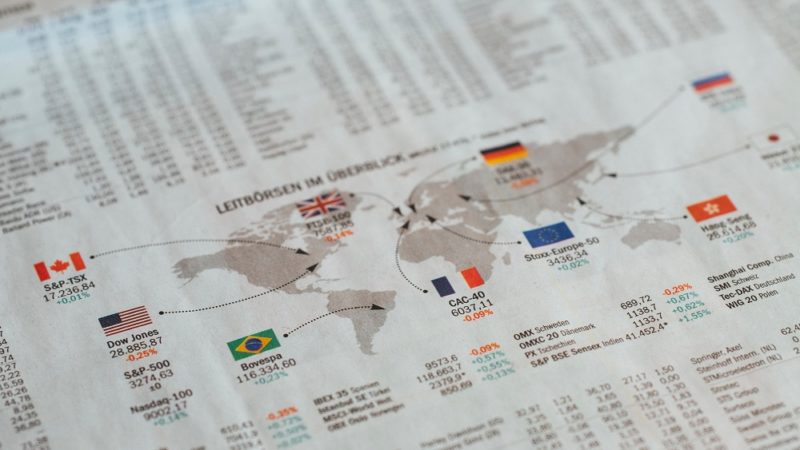

After the Dow Jones Index hit its record all-time high in February, the trademark index fell 28%, meanwhile, S&P 500 fell 26% since the same period. This is a record fall in these benchmark indexes and this is clearly due to the coronavirus pandemic. Many experts have said that the economy is already into depression.

Yusko recommends the investors to avoid major losses by cashing out their positions as it’s not too late for the same and markets are yet to hit their bottom. This statement of Yusko came at a day when the global inflation has crossed $1 million globally. He also considers companies that are heavily debt-ridden as bearish including the consumer and retail stocks.

“Cash is king,” Yusko said. “We’re in for a very drawn-out bear market.” He also admits that the plausible fall of the economy at the global level would expend to numerous coming quarters and years. Yoshi personally indicated that out of his $1.7 billion assets under management, he himself has sold “a lot of stocks” currently.

Apart from cash, he considers growing markets and gold miners as fairly attractive from a valuation point of view. He thinks Bitcoin is attractive as well. “It’s an insurance against the collapse of the financial system,” Yusko said.

“But what I am saying is that the [stimulus] response from the government… is going to have a negative impact on currencies globally, particularly western currencies. So, you want to have something that appreciates in value. Bitcoin is going to do that.”