Challenges Faced While Owning a Strong Currency

Owning a strong currency may prove to be very arousing for countries. A booming currency acquires many positive points, and it makes the goods and services of a country, more expensive in comparison to other countries having less valued currencies. Owning a strong currency can aggravate a combative condition, which can be hard for regulators to go across.

Central Bank Regulation

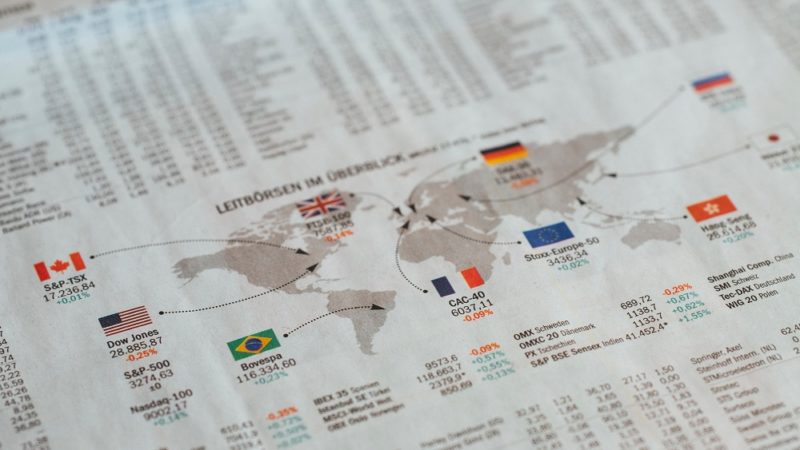

An important attribute that can alter currency values is central bank regulation. As soon as these economic conventions proceed to implement changed policy descriptions, measurable fluctuations are introduced in foreign exchange rates. The Federal Reserve lowers interest rates near to all-time lows as well as implemented three individual bond-purchase events, including the last one resulting in October 2014. The Fed removed its quantitative easing (QE) before the other countries’ central banks, as the financial base of the U.S. amplified faster than that of any other country.

In July 2016, the Bank of Japan declared that it would not only up to purchase fixed-income securities but also increase the purchases of equity-traded funds from 3.3 trillion yen to 6 trillion yen. Market competitors started pushing the yen higher in comparison to other main currencies, an increment that disappointed Japanese regulators and likely attacked the plea of the country’s exports.

Exports

If a country is owning a strong currency, its customers can conveniently buy goods and services from foreign countries in cheaper pricing. But its exports can be affected because they become more expensive to foreign countries. Exports indicate the continuance of foreign currency into a country, so a fall in exports can generate noticeable financial antipodal.

Protocol’s Progression

After the declaration of the Bank of Japan, various central banks adopted the trend to make more effective financial policies. The Reserve Bank of Australia (RBA), decreased its standard interest rate to a record low of 1.5% in August 2016. The main announcement that came out of the meeting was that “there was a reasonable likelihood of further stimulus by a number of the major central banks” and advised the RBA to regulate this policy for guarding the rising value of the Australian dollar.

Similarly, the Bank of England (BOE) also declared alterations to financial policy in August. The BOE increased quantitative easing, reduced interest rates, and accomplished 100 billion pounds to give a try to boost up lending.